McGill hosted the world’s first business-school competition focused on the asset allocation of pension funds on Nov. 3 – 4. The inaugural McGill International Portfolio Challenge (MIPC) welcomed 25 finalist student teams from leading institutions around the world, with some traveling from as far away as Australia, Hong Kong and Switzerland to pitch their proposals to a panel of judges from several of Canada’s largest asset managers.

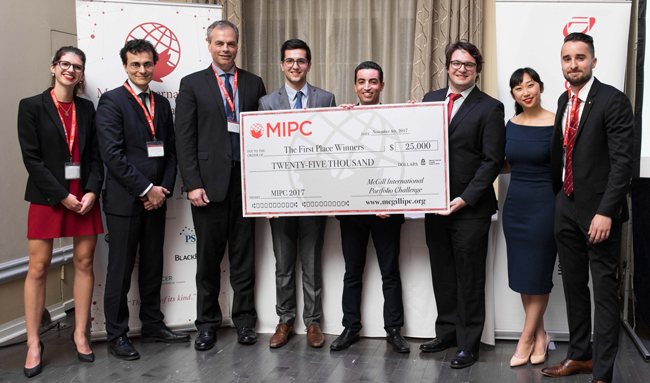

The C$25,000 first-place prize – one of the largest awarded in any business-school competition – went to the HEC Montreal team “Quantamental Solutions.” An additional C$25,000 of cash prizes were shared among the four runner-up teams from the Illinois Institute of Technology, St. Mary’s University, University of Sydney, and McGill.

Crafting solutions to an endemic problem

MIPC is the first contest to address the endemic problem of underfunded pensions. Student teams were presented with a fictional case of a severely underfunded, defined-benefit pension fund in a mid-sized Canadian forestry company. They had to examine the fund’s asset allocation and then creatively determine investment solutions that met the needs of all stakeholders involved – by no means a simple or a straightforward task.

More than 40 teams from around the world submitted proposals, and from these submissions 25 teams were selected to participate in the finals at McGill’s Desautels Faculty of Management. The judges awarded the winning strategy to HEC Montreal for its creative solution involving sophisticated derivative instruments, such as options and futures, that would enable the fund to boost returns while limiting risk in the event of a market downturn.

“The quality of the student work was outstanding,” said Sebastien Betermier, Associate Professor of Finance at Desautels. “Teams spent an incredible amount of time and effort creating innovative and elegant strategies that may lead to viable solutions.”

A first-of-its kind competition

The competition is the result of 18 months of hard work from a group of Desautels’ undergraduate students under the mentorship of Professor Betermier. ‘These students embody the best of what we hope for in our graduates and should be proud of what they’ve accomplished,’ says Betermier. ‘They have been involved in every single step of this initiative and worked tirelessly to make it a first-of-its-kind competition on pension asset allocation.’

Johanna Diao, a graduating student with a major in finance at Desautels, described her involvement as intense but highly rewarding in the end. “MIPC has truly been the highlight of my experience at McGill,” says Diao. “Over the past 2 years, building this initiative from scratch has at once been the most daunting yet rewarding task; it has shaped the way that I approach professional relationships, and has allowed me to frame the basis of my understanding about pension funds.”

Betermier sees the novel competition as “an endeavor towards finding solutions for underfunded pensions by bringing together key stakeholders with student talent. The idea is to come up with a new case each year that addresses a different angle of the pension crisis.”

“I’d like to applaud McGill for organizing this event,” says Gary Grad, Chief Investment Officer at CIBC Asset Management, who was the opening speaker and one of the final-round judges. “It is uniquely focused on multi-asset portfolio construction and asset allocation designed to solve a specific and ubiquitous problem. The competition is well aligned with market trends that have clients demanding investment solutions to their problems.”